Several states have confirmed their plans to tax student loan forgiveness, with Indiana being the latest addition.

President Biden announced in August that he plans to forgive $10,000 in student debt for borrowers making less than $125,000 annually.

Pell Grant recipients with an income below the $125,000 threshold will receive $20,000 in debt relief.

In addition to loan forgiveness, Biden decided to extend the pause on student loan payments through the end of the year.

“All of this means people can start to finally crawl out from under that mountain of debt to get on top of their rent and their utilities, to finally think about buying a home or starting a family or starting a business,” the president said.

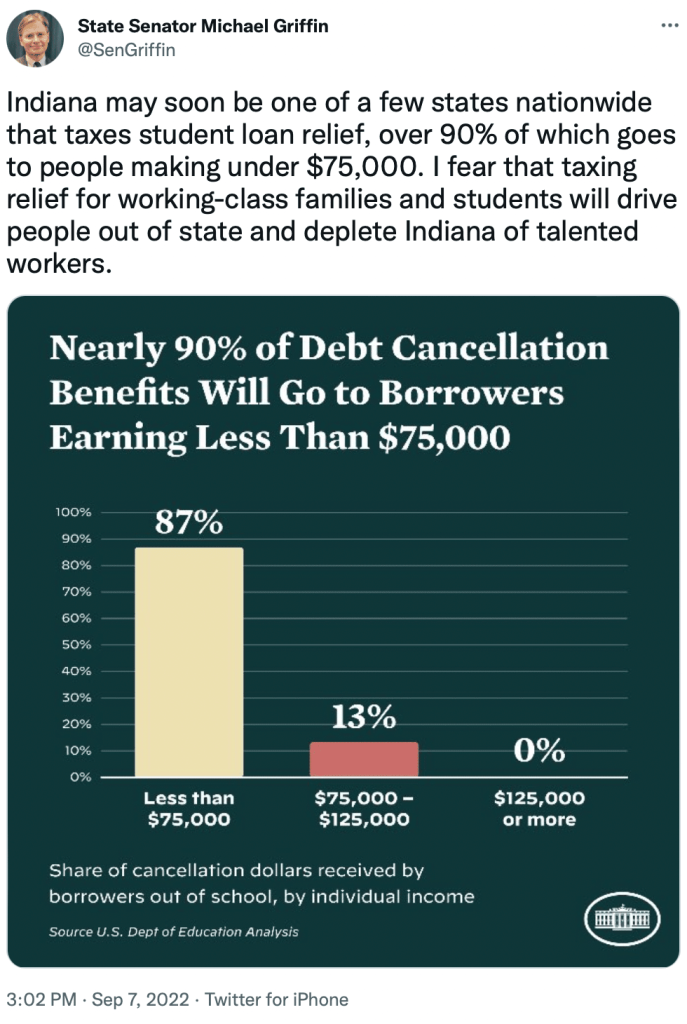

The White House claimed that the debt relief is “fully paid for” through already occurring deficit reduction.

The National Taxpayers Union Foundation recently issued an analysis estimating that the student loan handout will add approximately $330 billion to the deficit over the next decade.

So far, Mississippi, Minnesota, Wisconsin, Massachusetts, Arkansas, Indiana and North Carolina have announced that they will charge state tax on student debt handout funds.

As tax laws vary from state to state, it’s unclear what each state will decide to do.

Borrowers in Mississippi making less than $125,000 per year may owe an additional $500 in taxes if they have $10,000 of student loan debt forgiven.

Pell Grant recipients are eligible for $20,000 in student loan forgiveness and may owe an additional $1,000 in taxes.

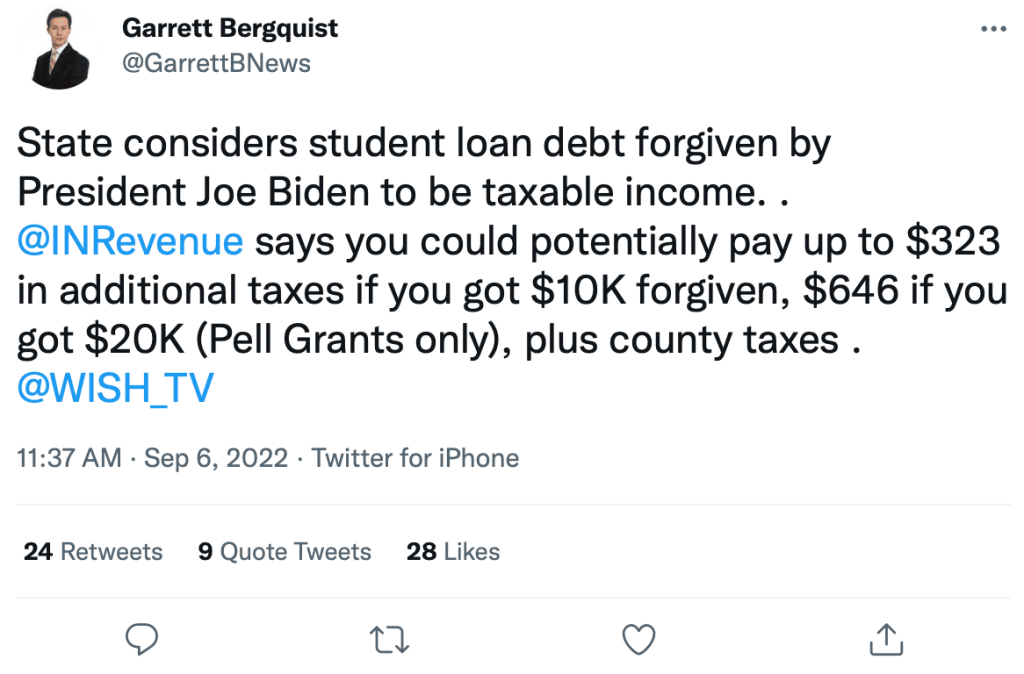

On Tuesday, Indiana announced it will tax student debt relief as income.

Indiana’s tax rate is currently 3.23%, meaning those eligible to have their debt canceled will owe up to $323 or $646 in taxes depending on the amount of student loan forgiveness for which they qualify, according to AP News.

In addition, residents will have to pay county taxes for the forgiven debt.

Unless states change their laws to adhere to a federal tax exemption for student loans, the forgiven loans will be subject to state income taxes.

Democratic state Rep. Greg Porter of Indianapolis said “I can’t say I’m surprised Indiana has chosen to take a punitive stance on a policy meant to give working-class Americans relief, but there’s still time to change this.”

Fox News reported that Virginia, Idaho, New York, West Virginia, Pennsylvania and Kentucky are among the states that have confirmed they will exempt the forgiveness from taxes.

While many are frustrated with the news, others argue that the small amount in taxes is much better than the loan payments plus interest over time.