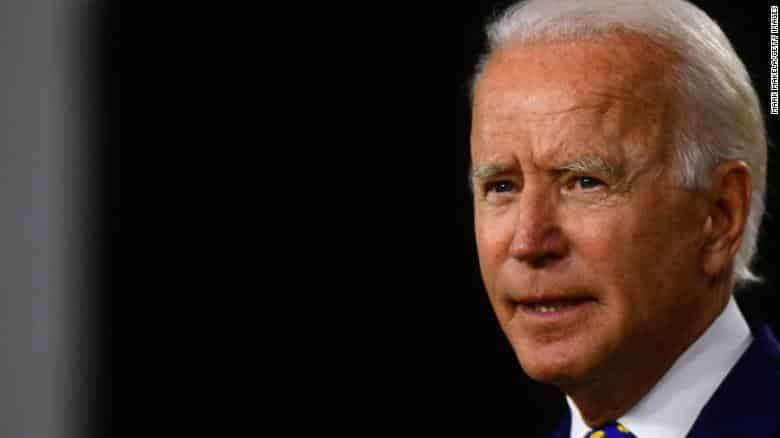

Biden’s tax hikes will not effect individuals making more than $400,000 a year. We have heard this lie echoed time and time again.

The Biden administration has now come forward and claimed that this threshold applies to households, and not individuals despite Biden’s rhetoric that has referenced the individual.

“No one, let me say it again, no one making under $400,000 will see their federal taxes go up, period,” Biden claimed. “No one” clearly referring to the individual rather than the household.

Yahoo reported: “But there’s that ‘no one’ again – it’s stretched, to say the least. The White House press secretary, Jen Psaki, clarified in a March 17 briefing that the $400,000 threshold applies to households, not individuals. That means, in instances where both heads of a household make $200,000, their taxes would likely climb under Biden’s plan.”

Biden, in his first press conference claimed that a driving reason that he ran for president was to restore transparency to the White House, and yet he casts a shadowy veil over his administration and intentionally misleads the American people.

Yahoo defends this by claiming that while this is misleading, it will only effect a sliver of American households.

There are two key issues.

Biden’s lies and intentional bad faith nature effects all Americans not just those making more than $200,000 a year.

The second issue is that while Americans outside of the 98th percentile are not directly effected by tax hikes, they will be effected by the ways members of that percentile attempt to offset the loss.

If a business owner has his taxes raised, he will I turn raise his prices to cope with the loss. If he is a landlord, he will raise his taxes.

Many Americans including Biden fail to realize the indirect consequences of raising taxes on the wealthy