Listen Here

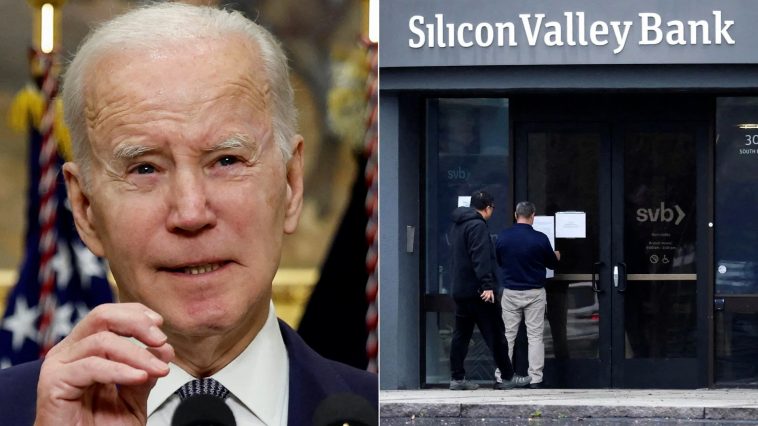

On Friday night US regulators stepped in and shut down Silicon Valley Bank. They then announced late Sunday night that it would guarantee all deposits that were made to SVB. Government officials also revealed that they shut down a second bank, Signature Bank of New York.

NEW:

*Signature Bank has been closed

*All depositors of Silicon Valley Bank and Signature Bank will be fully protected

*Shareholders and certain unsecured debtholders will not be protected

*New Fed 13(3) facility announced with $25 billion from ESF to backstop bank deposits pic.twitter.com/LKipIRMg1T

— Nick Timiraos (@NickTimiraos) March 12, 2023

The Federal Reserve plans to create a separate lending facility in order to protect other banks from the ripple effect. Whether this will be enough to stop the bleeding or not is another story. Regulators stepped in fearing that if they had not done so, it would trigger a broader financial crisis.

U.S. says ‘all’ deposits at failed bank will be available Monday

The Federal Reserve announced that it is creating a new lending facility for the nation’s banks, to buttress against financial risks from Friday’s collapse of Silicon Valley Bank.#BankCrash #BankRuns #BankingCrisis— sudhir arora (@suda712) March 13, 2023

The US Treasury Department put out an official statement saying – “Today we are taking decisive actions to protect the U.S. economy by strengthening public confidence in our banking system.”

But what does it all mean? The FDIC will guarantee all deposits at SVB and Signature Bank. Even those amounts ranging higher than the guaranteed $250,000 limit. This is in hopes that people will then feel their money is safe and keep it in the banks.

https://twitter.com/sosReports/status/1635237310492200962?s=20

The government also tried to ensure us that most banks will never get this close to an actual collapse and so the program they intend to rollout comes with “generous terms.” They will lend to the banks who put up there assets as collateral, however, the evaluation of these assets will be at the inflated price the bank purchased them at and not at current market value. Might stop the temporary bleeding but also could lead to a slew of problems in the future.

CONTINUE READING FOR THE ASSESSMENT OF THE PROPOSED BAILOUT