Unforeseen circumstances are creating challenges for Tesla as the automaker witnesses a significant downturn in sales. Competing brands are swiftly closing the gap, posing a threat to Tesla’s dominant market position. Recently, a series of unfavorable events have put Tesla under the spotlight, yet attributing these occurrences solely to the political affiliations of its CEO would be speculative. It’s a known fact that Tesla experienced its first-ever contraction in worldwide sales last year, seeing a subtraction of 1% from its 2023 figures.

For various businesses, such a minor decline may appear insignificant, but for an enterprise renowned for its consecutive sales surges of 38% and 40% in the preceding two years, it’s a highly unusual event. Furthermore, Tesla’s staggering share price growth over the last ten years is primarily based on expectations of future expansion. On a shorter timeline, Tesla’s U.S. sales did experience a sudden fall of 16% between December and January.

However, this kind of fluctuation is typical for the powerhouse automaker due to their year-end sales strategy to meet expected financial results, followed by a subsequent decrease in January. But the problem Tesla faces is not just about a CEO who is actively involved in several other enterprises along with his responsibilities at the federal level. With a complex web of potential influences, it becomes challenging to isolate and attribute Tesla’s current predicament to any particular source.

At this time frame, it is premature to attribute a societal backlash to Tesla’s numbers. Assumptions about political division influencing Tesla’s sales figures remain speculative at this point. The most indicative shift in Tesla ownership interest can be seen from data gathered by S&P Global Mobility. Their set of comprehensive data delves into Tesla’s sales across individual states, further categorizing them into ‘blue’ and ‘red’ states.

This categorization hinges on the fraction of Tesla-owning households that repurchasing a Tesla when acquiring a new vehicle. In the ‘blue’ states, there has been a decline from 72% in the last quarter of 2023 to 65% in the last quarter of 2024 in repeat Tesla buyers. Meanwhile, red-state repeat Tesla purchasers have seen a marginal increase, rising from 47.6% at the end of 2023 to 48.2% in the final three months of the previous year.

The decline in Tesla customer loyalty within the ‘blue’ states has led to a reduction of about 1% in Tesla’s overall market share in these regions, which includes some of the country’s largest car markets like California. A potential backlash against Tesla could be inferred by watching the used Tesla market and understanding if owners are deciding to part ways with their vehicles. Currently, there is a trading-in surge with an average number of Teslas listed on AutoTrader reaching a new high at about 11,300 throughout the last quarter of the previous year, a 28% climb from an average of 8,800 the year before.

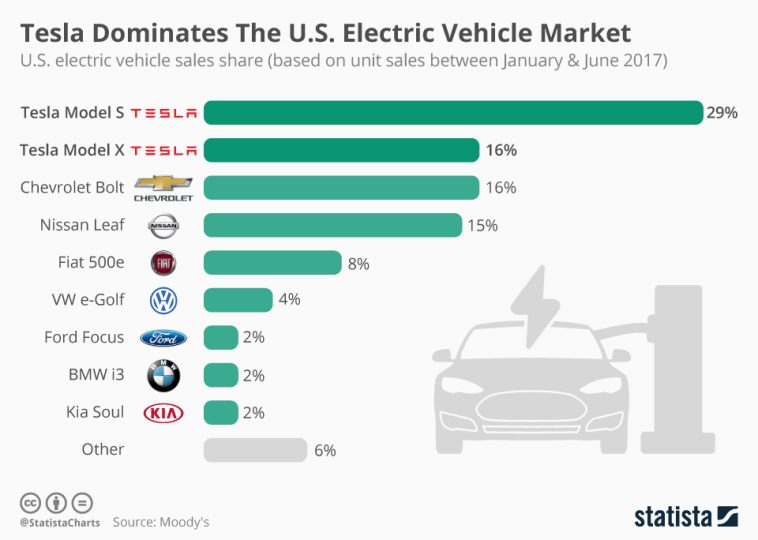

Nonetheless, such a surge in trade-ins is likely more reflective of trends following the post-pandemic sales hike three years ago and the norm of owners trading in vehicles after a three-year period. There are numerous other determinants arguably contributing to a dip in new Tesla sales, not least important of which is the accelerated competition. Seasoned Western auto manufacturers including the likes of General Motors, Ford, and Volkswagen have been launching their models of electric vehicles over the past few years, offering potential lower price points than Tesla.

By contrast, Tesla has introduced relatively modest alterations to its principal lineup. The only novel addition, the Cybertruck pickup, is a high-priced niche offering that has reported only average sales figures. There’s also considerable new competition directly from the East, with Chinese automaker BYD nearly matching Tesla in terms of global EV sales and significantly surpassing it during the last quarter of 2024.

BYD has managed to outpace Tesla in markets of China and Europe taking over sizeable market shares, though it has not yet made its way into the U.S. automobile market. According to the data published by the German Federal Motor Transport Authority, Tesla’s sales in Germany dwindled by 59% in January compared to the same month the previous year. Consumers’ choice of cars is usually a major, deliberate decision, second only to housing in terms of monetary value.

When selecting a vehicle, consumers typically prioritize factors like cost, features, and perceived value over the personal ambitions or political views of the CEO. Ultimately, it’s important to emphasize that many elements contribute to the fluctuations in Tesla’s sales. Despite noticeable challenges and increasing competition, it’s premature to land on any definitive conclusions regarding the cause of Tesla’s declining sales, or potential effects in the long run.

While Tesla’s robust growth in previous years has been commendable, it’s normal for any business to face periods of slowdown and challenges. And Tesla, despite its cutting-edge technology and market-leading position, is no exception. The rapidly evolving automobile industry, marked by increasing competition and shifting consumer preferences, presents a constantly evolving landscape for automakers to navigate.

As the disruption in the world of automobiles continues to augment, Tesla’s product strategy is something that will likely undergo scrutinous evaluation. Perhaps, the brand will benefit from diversifying the lineup or creating more affordable options for a wider consumer base. Continuous adaptation and critical self-evaluation will remain key in managing to stay ahead of the curve and sustaining a dominant market position.

Though it currently confronts a shift in customer loyalty and the rise of formidable competitors, only time will tell the course Tesla will take to manage its position in this dynamic market. The company’s trajectory has always been subject to changes in the broader socio-political and economic landscapes. Whether the current unfolding events are temporary setbacks or precursors to more significant changes, remains to be seen.

One thing remains clear though – the world of electric automobiles is expanding and evolving rapidly, and it’ll take more than just a unique market position or a charismatic, outspoken CEO to remain a market leader in the long run. This moment can be seen as a reminder that constant innovation, the ability to adapt, and a deep understanding of customer needs are the keys to sustained success in the burgeoning EV market.

In conclusion, Tesla’s relatively stark sales decline undoubtedly points toward a complex convergence of factors, including increased competition, political climate and overall market dynamics. As the episode unfolds, careful analysis, unhurried judgments, and complete comprehension of the numerous intertwined influences will be needed to accurately deduce the situation and plan the next steps. The course ahead for Tesla certainly promises to be an interesting one, filled with opportunities and challenges alike.