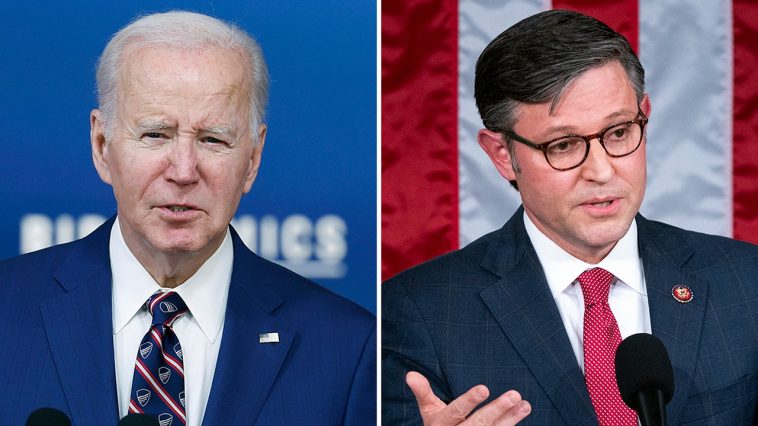

In a recent discussion on CNBC’s ‘Squawk Box’, House Speaker Mike Johnson voiced his strong concerns about President Joe Biden’s latest budget plans. Without hesitation, Johnson criticized the President and his party for their desire to persistently ‘boost spending’ and the contents of their $1.2 trillion spending package.

Host Joe Kernen initiated the conversation with the Speaker after speaking with Maya MacGuineas about the long-term effects of these spending and revenue strategies. MacGuineas expressed her concern over the outcomes of this budget plan, from which she found no positive attribute. Kernen inquired Johnson’s view on this matter, in particular reference to high-ticket items like Social Security or Medicare that neither Presidents don’t seem eager to modify.

In reply to Kernen, Johnson expressed a clear refutation to consider cutting essential programs like Medicare and Social Security. He then relayed his perspective on the issue. Following his critique of the effects of the Biden administration’s budget, including the largest tax increase in U.S history amounting to approximately $4.9 trillion, Johnson expressed alarm about the potential increase in national debt to a staggering $52 trillion over the next decade.

Johnson, taking a stand for conservative principles, warned about the risks of following a budget plan that can lead the nation into economic instability. He expressed his plea: ‘We must not tread upon this path that can potentially plummet our economy.’ He and his colleagues believe that to steer the economy in the right direction, the nation needs to follow a different fiscal philosophy.

He further shed light on an alternative approach proposed by the House Budget Committee. The plan presents a practical solution and aims to balance the federal budget within a decade by trimming approximately $15 trillion in spending without impacting Social Security or Medicare.

Johnson emphasized that executing this plan requires robust political decisions and a steadfast commitment to limiting the spread and scale of federal governance. For him, these are not novel concepts; instead, they’ve been part of the discourse for some time. However, actualizing these concepts would take decisive action, political courage, and, most importantly, appropriate policy choices.

Articulating his trust in his party’s resolve and decisive action, Johnson expressed his conviction that despite immense stakes, they could prevent the economy from falling into a precarious situation. He was confident in their ability to make the right policy decisions to safeguard the economy.

Becky Quick, the co-host, shifted the conversation to the possibilities of establishing another commission to address the nation’s economic challenges. She suggested a solution resembling the Simpson-Bowles strategy but with a stronger, more enforceable impact. She asked Johnson’s stance on such an initiative.

Johnson demonstrated openness on the matter, advocating for a bipartisan and bicameral commission for economic review and solution. However, he issued a cautious note on not embarking on such an effort with a preconceived notion of raising taxes. Raising taxes, according to Johnson, is problematic for a country grappling with the economic effects of a crisis.

As a strong proponent of limited government and fiscal conservatism, Johnson cherishes the principle of tax relief for those contributing to the economy such as innovators, hardworking families, and risk takers. He supports the reduction of regulation to catalyze economic growth, claiming that these strategies were effective during the first two years of the Trump administration.

During the discussion, Quick questioned Johnson about the bipartisan nature of the proposed committee would be compromised if it were developed with such a singular view on not increasing taxes. She argued that successful initiatives, such as Simpson-Bowles, were predicated on a balanced approach to both raising taxes and cutting revenue.

Johnson acknowledged the place for considerate discourse and welcomed the scrutiny of all possibilities. However, he also advocated for the necessity of preserving conservative fiscal values. He cited the example of the first couple of years in the Trump administration, arguing that economic prosperity was achieved because of the implementation of these principles, which included tax cuts and transformative regulatory reforms.

In conclusion, the speaker articulated his eagerness for a new wave of principled governance that he believes would be capable of positively turning the economy around. With the optimism of a unified government committed to these principles in the upcoming term, Johnson has high hopes for a brighter economic future.