Amidst the anticipation of potential strikes by the United Auto Workers union, General Motors has taken measures to secure a new line of credit valued at $6 billion. This strategic move by the automaker aims to support its balance sheet, as signs suggest that the union might prolong and expand their strikes against the company.

The decision to establish this credit line is driven by the cautionary messages conveyed by some of the UAW leadership, indicating a potential extended duration of the strikes. GM’s Chief Financial Officer, Paul Jacobson, emphasized the importance of this $6 billion credit line in an interview with CNBC’s Phil LeBeau on the “Halftime Report.”

During the third quarter, the targeted strikes initiated by the United Auto Workers union have already inflicted a financial blow on General Motors, resulting in a cost of $200 million. This substantial hit to the automaker’s finances further underlines the need for strategic measures to mitigate the impact of ongoing strikes.

In response to lost production on wholesale volume, mainly resulting from the UAW’s initial strike on September 15 at GM’s midsize truck and full-size van plant in Wentzville, Missouri, GM has faced adverse effects across its parts and distribution facilities nationwide. Subsequently, the strikes extended to include a crossover plant in mid-Michigan.

The repercussions of the strike in Missouri were not limited to a single location. General Motors was forced to idle its Fairfax Assembly Plant in Kansas, which is responsible for manufacturing the Cadillac XT4 SUV and the Chevrolet Malibu sedan.

The idling of this facility resulted in the layoff of almost 2,000 workers. Such ramifications highlight the severity of the strikes and the global impact they have had on GM’s operations. In light of these circumstances, the new line of credit obtained by the automaker is crucial in ensuring that the company remains financially stable and capable of navigating these challenging times.

The recently secured $6 billion line of credit takes into consideration certain conditions that General Motors must fulfill. These conditions include maintaining a minimum of $4 billion in global liquidity and $2 billion in U.S. liquidity. Additionally, the credit agreement places restrictions on GM, prohibiting mergers or sales of assets and imposing limitations on incurring new debt.

These terms illustrate the careful planning and considerations involved in securing the line of credit, which aims to provide stability and support during the ongoing challenges faced by the automotive industry.

Amidst the automaker’s movements to secure a line of credit, its competitor Ford also took similar precautions by obtaining a $4 billion line of credit over a month ago. Ford’s actions reflect a shared concern within the industry regarding the prevailing uncertainties and challenges faced in the market.

By taking proactive measures to ensure financial stability, both General Motors and Ford intend to address potential risks and fortify their positions in the face of an ever-evolving landscape.

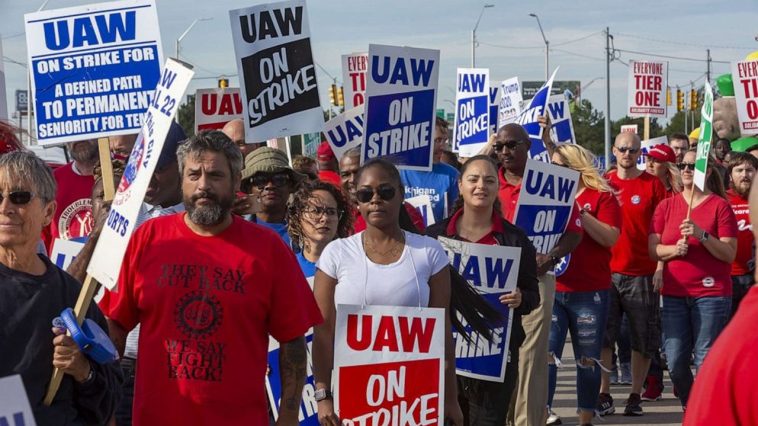

The automotive sector is significantly impacted by organized labor disruptions, as exemplified by the ongoing strikes initiated by the United Auto Workers union. These strikes not only incur significant costs for the companies involved but also disrupt production and operations across the industry as a whole.

As General Motors continues to brace for potential prolonged strikes, the securing of a $6 billion line of credit demonstrates the automaker’s commitment to weathering any further storms in the labor market.

General Motors’ decision to secure a new line of credit allows the company to strengthen its financial position as it faces the United Auto Workers union strikes head-on. The $6 billion line of credit reflects GM’s cautious approach to uncertainties posed by the prolonged strikes anticipated by the union.

By establishing this strategic financial cushion, the automaker ensures it can endure any escalation in the labor disputes, providing reassurance to stakeholders and investors alike.

The strikes initiated by the United Auto Workers union have posed significant financial challenges for General Motors, leading to a loss of $200 million in the third quarter. This financial setback further underscores the importance of securing a new line of credit valued at $6 billion.

As the strikes continue across various plants and facilities, the impact on GM’s production and distribution network is magnified, necessitating proactive measures to maintain stability in operations and financial standing.

The ripple effects of the strikes are far-reaching, extending beyond individual plants to impact entire supply chains. For General Motors, the closing of its Fairfax Assembly Plant in Kansas due to strikes has significant consequences for the workforce and automotive production.

The knock-on effects of such closures highlight the widespread disruptions caused by organized labor actions, emphasizing the need for proactive financial maneuvers to mitigate adverse impacts in the future.

To secure its financial stability amidst ongoing strikes, General Motors has obtained a $6 billion line of credit. This credit facility is seen as a prudent move by the automaker, considering the announced intentions of the UAW leadership to prolong the strikes.

The strikes have already cost GM $200 million in the third quarter, largely due to production losses resulting from the initial strike at GM’s midsize truck and full-size van plant in Wentzville, Missouri. The subsequent expansion of strikes to other plants necessitated a strategic response from the automaker.

In response to the ongoing labor strikes conducted by the United Auto Workers union, General Motors has taken a proactive approach by securing a $6 billion line of credit. This financial measure aims to strengthen GM’s capital structure, as signs indicate the potential for the strikes to extend over a longer period of time.

By bolstering its balance sheet with this credit facility, GM can better navigate the challenges posed by the labor market disruptions, safeguarding the company’s operations and stability.

General Motors’ decision to secure a $6 billion line of credit reflects the automaker’s preparedness for the potential escalation and duration of strikes by the United Auto Workers union. As the targeted strikes have already incurred a significant cost of $200 million in the third quarter, GM takes a proactive step to manage the financial impact of the ongoing labor disputes.

By reinforcing its balance sheet through this credit facility, the automaker demonstrates its commitment to mitigating any adverse effects the strikes may have on its business operations.

To strengthen its financial position in the midst of ongoing strikes, General Motors has secured a new line of credit worth $6 billion. This move is prompted by the expectation of extended and intensified strikes by the United Auto Workers union, which have already cost the automaker $200 million in the third quarter alone.

By acquiring this credit line, GM aims to ensure the availability of sufficient liquidity, enabling the company to pursue its strategic objectives and maintain stability in the face of labor disputes.

With the United Auto Workers union strikes taking a toll on General Motors’ financials, the automaker has secured a new line of credit amounting to $6 billion.

This decision comes as a proactive measure to safeguard GM’s financial health, given indications of potential prolonged strikes by the union. These labor disputes have already incurred a cost of $200 million during the third quarter, emphasizing the need for GM to bolster its balance sheet and maintain adequate liquidity.

General Motors has acted swiftly to address the financial implications of ongoing labor strikes by obtaining a new $6 billion line of credit. As the United Auto Workers union strikes continue, GM faces significant costs, totaling $200 million in the third quarter.

This credit facility provides the automaker with the necessary resources to manage these financial challenges and maintain resilience amid the labor unrest in the automotive industry.