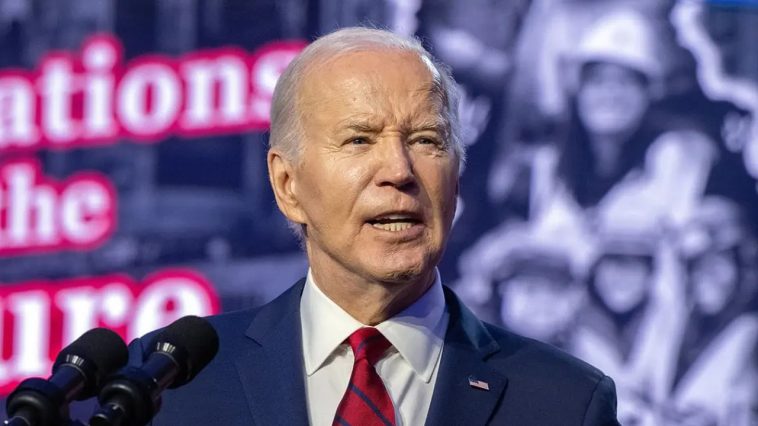

The recent tax initiative proposed by President Biden suggests a significant increase in the maximum rate levied on capital gains, stretching the tax rate to an unprecedented level unseen for over a hundred years. Economic pundits have expressed heavy opposition towards this initiative, citing evidence of its potential to considerably impair the vigor of the American economy.

This paradigm shift in taxation, might indeed feel like a slap in the face to those who have long valued America’s tradition of fostering entrepreneurial spirit. The proposed escalation would hit the hardest on wealth created through business capital gains, a cornerstone of the free-market system which has proven uniquely American.

The inference is clear: President Biden’s potentially detrimental initiative could stifle innovation by disincentivizing entrepreneurship and risk-taking. It’s not lost on anyone the consequences of such a grim reality-the potential stagnation of the U.S. economy, a scenario nobody wants to see.

An alarming implication of this policy becomes swiftly evident. Would investors think twice before investing in stocks, real estate, or other forms of capital ventures? The proposal most certainly puts incentives for innovation and risk-taking at risk, which might induce stagnation into an otherwise vibrant economy.

The president’s proposed tax hike could place the United States at an economic disadvantage in the global arena. In a highly competitive world where countries are competing for investments, such a policy could dissuade capital inflow into the U.S., weakening the country’s position globally.

Moreover, the fundamental principle of a low capital gains tax is to encourage investments, and in turn, stimulate economic growth. The President’s proposal raises the question: Are we ready to forfeit that growth in exchange for a short-term surge in revenues?

Economists argue that capital gains taxes are directly proportional to investment; raising them could ultimately discourage investments. It raises concerns about the possible negative implications of this policy- that it might be precipitating a new era of economic uncertainty.

Let’s also bring taxes’ impact on job creation into the picture. By increasing the tax burden on investments, we might see a diminished pool of resources available for the creation of new jobs. It is a consequence that could affect everyone, no matter if they’re directly involved in the investment process or not.

Equally detrimental could be the ripple effect of decreased liquidity in the market caused by the proposed tax hike. If investors become skeptical about the potential returns on their investments due to increased taxes, they may hold back from participating in the market. This could restrict the flow of capital, increasing financial risk and decreasing market stability.

This tax proposal, therefore, is not merely an abstract financial policy issue; it is an issue touching on every American’s life. It might ostensibly be about revenue collection, but the realities underpinning the policy could reach far beyond just investors. The impact could stretch to include everyone from entrepreneurs to employees to consumers.

In conclusion, while the proposed tax hike on capital gains may generate immediate revenue, it appears to overlook the longer-term ramifications. The potential risk to the U.S.’s economic vitality and global competitiveness is a matter of deep concern. Traditionally, fiscal prudence has been one of America’s strong suits, making this a potential departure from the path that has led to prosperity.

As we reflect on this proposed shift in our fiscal approach, let’s remind ourselves of the importance of retaining strong American values like entrepreneurship, risk-taking, and competition. Let’s not forget that we are a nation that thrives on prosperity, and that prosperity is built on the bedrock of a vibrant economy.

Critics of the proposal argue that it is imperative to balance short-term revenue gains with the long-term health of our economy. It might be more beneficial to uphold a fiscal system that spurs both economic dynamism and fairness, instead of leaning towards policies that compromise one for the other.

In essence, while the policy aims to address wealth disparity, it could end up shriveling the country’s economic growth and vibrancy. A taxation system should ideally strike a balance-where it doesn’t severely inhibit economic growth while achieving fiscal equity. It is the essence of pragmatic fiscal policy, a tradition deeply ingrained in the American way.

It, therefore, becomes vital for our nation to critically examine this tax proposal. Other ways of addressing wealth disparity without harming the economy must also be explored. After all, we need policies that ensure the continuing strength and vitality of America’s economy, keeping in line with the values we hold dear.