Donald Trump, in a recent discussion at the New York Economic Club, confidently claimed that tariffs could generate huge revenue for the country’s coffers. Strangely, he may not be considering that his high hopes for tariffs and his commitment to combating inflation seem to be in conflict. American citizens consistently report inflation as a primary issue, keeping in mind the considerable dent caused by the post-pandemic price hikes. The inflation rate might have settled a tad at 2.5%, but the price surge, particularly with food and housing, has been a lasting blow.

These concerns related to inflation dominated the opening segments of the recent presidential debate. However, Trump’s proposed methods to address these issues, leaning heavily on tariffs, have raised eyebrows among economists. Because his tactics are likely to exacerbate inflation, some experts question his approach. This scepticism doesn’t appear to affect his popularity in the business circles, primarily because of his other policies like deregulation and lower corporate tax rates.

Even Goldman Sachs, one of the largest investment banks in the country, sounded an alarm about Trump’s blanket tariffs plan. They suggested these steps could potentially escalate inflation by around 1.2% in 2025. Additionally, Trump’s other proposals, such as deficit-causing tax cuts, pressure on the Federal Reserve to decrease interest rates, and the large-scale deportation of undocumented immigrants, could fuel inflation, warned some analysts.

Economists express concern, pointing out that with historically low levels of unemployment and incrementally increasing wages, sharp tax reductions and interest rate cuts could initiate a new wave of inflation. This is largely due to inflation’s correlation with supply-demand dynamics. The Trump’s economic promises could trigger a demand surge, and the tight labor market might not be able to scale supply accordingly. A move to reduce the labor force by deporting millions could also lead to supply shortages according to some experts.

Despite these cautionary analyses, a number of economists note that Trump’s tenure included tax cuts and tariffs implementations without setting off an inflation explosion. Regardless, concerns are valid as Trump’s measure to ‘outrid inflation’ are unspecific and ambiguous. Let’s look at how four of his proposals could stoke inflation, according to certain economists.

Tariffs are essentially a fee charged on imported goods, aimed at supporting local manufacturers. Trump’s proposition of applying 10% to 20% tariffs on all $3 trillion of annual imports, along with a massive 60% for Chinese goods, seems ambitious. He previously imposed tariffs on $380 billion worth of imported merchandise.

According to research from the National Bureau of Economic Research, contrary to Trump’s claim, consumers bear the brunt of tariffs, not foreign countries. A study by the New York Fed found that Trump’s tariffs contributed to an average additional annual expense of $831 for each household. His looming round of tariffs could push this yearly figure to over $2,600 for the typical middle-income household, as per data from the Peterson Institute.

While the more liberal Center for American Progress Action Fund suggests that Trump’s proposal might put an even higher pressure on average families with costs soaring up to $3,900 per annum. It’s worth noting Kamala Harris appears to echo these sentiments, regularly citing these statistics. But then again, her campaign claimed that she would also employ ‘targeted and strategic tariffs to support American workers.’ How targeting a narrow section of workers is beneficial overall isn’t very clear.

As per Trump’s previous actions as President, he had allowed tax cuts for corporations and individuals, which the Congressional Budget Office estimated would cost around $1.9 trillion over a decade. Trump made no efforts to balance these tax cuts with spending reductions. Furthermore, he approved new borrowing worth $8.4 trillion during his term – nearly double the amount compared to what Biden has done. The inflationary potential of tax cuts without corresponding spending cutbacks is a matter of concern, as it increases the money circulation stimulating demand that could lead to higher prices.

Concerning the labour market, wherein prices hinge on supply and demand, a lack of labour leads to escalating labour costs. Additionally, labour shortages subsequently lead to product shortages, in turn, causing price hikes. This might create worker shortages in sectors flooded with immigrants like agriculture, which can trigger further inflation.

Trump broke with conventional wisdom during his presidency when he intervened with the Federal Reserve’s interest rate setting, arguing for lower rates. These interest rate reductions typically lead to increased inflation as they decrease borrowing and spending costs, thus facilitating more consumer demand. Some economists also fear that politicizing the Federal Reserve might induce market anxiety, potentially spurring an inflationary spiral.

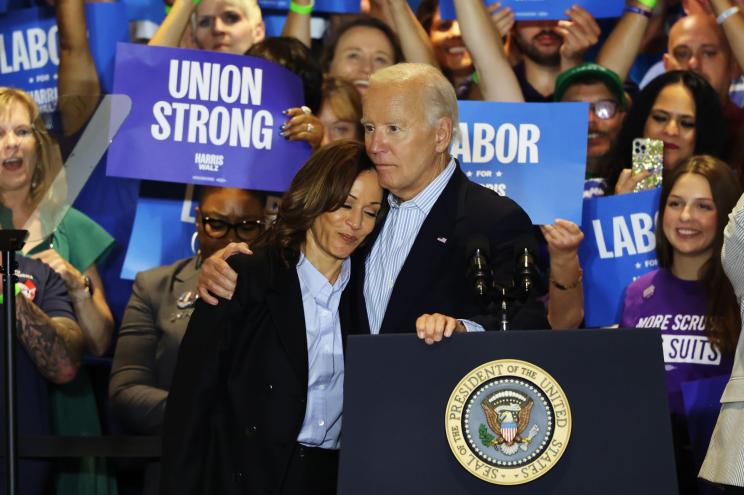

Kamala Harris adopts a distinctly different tactic to tackle concerns on rising costs compared to Trump. Instead of proposing an economy-wide inflation abolition, Harris targets cost hardships in specific areas profoundly affecting low and middle-income families. To some, this might sound like an appropriate and more focused strategy, although skeptics might question its real-life effectiveness.

Harris lays out proposals like a federal ban on food price gouging and plans to extend and expand price caps on essential drugs. These include the Biden administration’s $35 per month cap on insulin costs, which, strangely, met with opposition from Republicans. One wonders why ensuring affordable medication for citizens can be a topic of disagreement.

In a bid to mitigate high housing costs, Harris also has plans in place for downpayment assistance, a tax credit for first-time home buyers, and encouragement for new housing construction. Despite potentially appearing promising on paper, these proposals have a long way to go to prove their effectiveness at combating inflation in real life – only time will tell.