LISTEN HERE:

The financial stability of the American populace has come under increased strain due to escalating inflation rates, which have markedly shrunk real earnings. As a result, many individuals are finding it harder and harder to service their financial obligations, thus facing the harsh possibility of insolvency.

The sudden transition from timely debt payment to default has been widely observed during the third quarter of 2023, across almost all debt categories, barring student loans. These worrying findings have been brought to light by the Federal Reserve Bank of New York.

Waning economic fortitude in the United States, notably attributed to a the double blow of rising inflation and interest rates, has caused many Americans to struggle with balancing commitments that were once comfortably manageable.

This phenomenon was analyzed by experts speaking to the Daily Caller News Foundation. They draw a clear line between the deteriorating economic climate and the growing inability of consumers to fulfil prior debt obligations.

Taking a narrower look, it’s apparent that the delinquency transitions have had the most pronounced effect on the areas of credit card debt and auto loans. These sectors saw a sharp increase in third-quarter defaults, reaching 8% and 7.4% respectively. This is based on data gathered by the New York Fed, giving us an indication of the areas where citizens are feeling the economic crunch the most.

To elaborate further, credit card debt hit a staggering $1.08 trillion mark in the said quarter, recording a 4.7% rise from the preceding one, where for the first time it exceeded a trillion dollars in the annals of American finance. This is a telling sign on how the inflationary pressure is affecting consumers’ ability to manage their credit liabilities with dire consequences.

The average American wage earner has not been spared either, with real income having descended since the commencement of President Joe Biden’s tenure. The Federal Reserve Bank of St. Louis recorded that average real wages slipped 2.1% from the first quarter of 2021 to the third quarter of 2023. This deterioration of earnings has forced many citizens to dip into their personal savings to bridge the gap.

Indeed, it’s clear how dire the situation has become when looking at recent savings trends. As of September 2023, the cumulative savings for all Americans totaled $687.7 billion, a severe drop from May’s $1 trillion and the near $6 trillion of April 2020. It plainly illustrates how Americans are depleting their nest eggs to compensate for the squeeze in their real earnings.

In market dynamics, an ‘economic soft landing’ refers to the managed deceleration of market growth that prevents a full-blown recession, unlike a ‘hard landing’ which inevitably results in a recession. Such a soft landing also acts a dampener on rampant inflation. Jerome Powell, chair of the Federal Reserve, in his statement post the Federal Open Market Committee meeting held in September, seemed to discount the possibility of a soft landing from the current inflation reaction scenario.

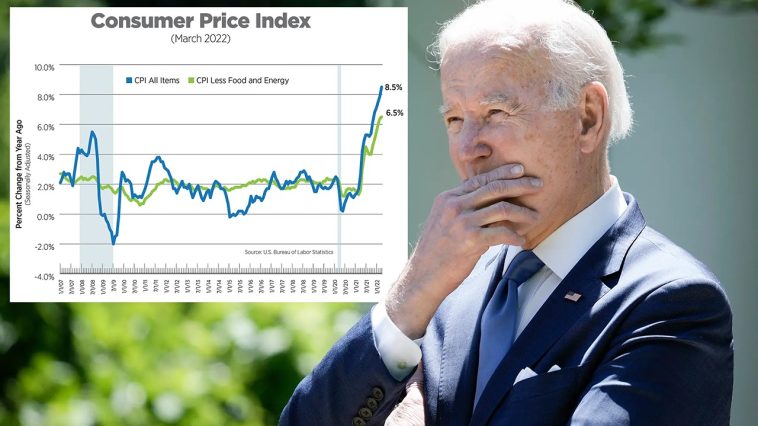

Inflation touched its zenith at 9.1% in President Biden’s tenure in June 2022, but since then has decelerated, however, it is still above acceptable levels, measuring at 3.7% in both August and September. This remains quite a distance from the Federal Reserve’s target of 2%, keeping the pressure up on the administration to control the ‘silent thief’.

To combat inflation, the Federal Reserve has increased its federal funds rate to between 5.25% and 5.50%, the highest in more than two decades. It made this decision after 11 successive rate hikes since March 2022, aiming to temper down the inflation fire threatening to engulf the economy.

In response to these conditions, the Biden Administration has moved forward with a series of substantial government spending packages. One of the key financial injections was the American Rescue Plan, introduced in March 2021. This pumped $1.9 trillion into the system in the form of stimulus checks and debt rescues, among other strategies.

Additionally, there was the signing of the Inflation Reduction Act. This authorized an influx of $750 billion in new spending, with a significant portion dedicated to initiatives aimed at addressing climate change. While these spending ventures aim to boost the economy, they also carry the risk of exacerbating the inflationary scenario.

As an indication of the wavering economy, the spending curve surpassed the income growth curve for the fourth consecutive month as of September 2023. This validates the widely held belief that recent trends in U.S. spending have largely been financed via savings and borrowing. The current state of the economy is putting a strain on all Americans to remain solvent and secure.

Actual increases in wages and salaries were noticed in September 2023, however this was not reflective in disposable incomes which instead saw a decline for the third consecutive month. This noticeably implies that the American consumer, in an effort to maintain existing and anticipated spending, has been saving less and less.

This means that consumers are resorting to live beyond their means to maintain their current lifestyle. This not only creates a disturbing trend, it also leaves them highly susceptible to any unexpected economic jolts. Ultimately, it outlines the enormity of the economic turbulence clouding America’s horizon.