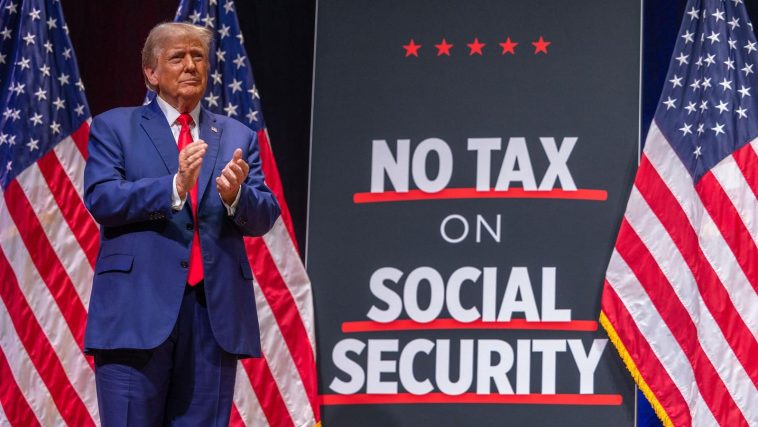

Soon-to-be resumed President Donald Trump has again outwitted his opponents, securing victory over Vice President Kamala Harris in the recent elections. Known for making bold decisions, Trump astounded retirees with his intention of abolishing Social Security benefit taxes. A clear distinction must be made between these taxes and the Social Security payroll taxes paid by every working American, contributing to the majority of Social Security’s revenue. The tax that Trump aims to obliterate only applies to retirees whos’ income surpasses certain levels.

At face value, Trump’s initiative seems to be an outright boon for seniors. A significant proportion of this demographic grapples with inadequate savings and the shrinking purchasing power of Social Security. However, there’s an obscure snag in this policy that could potentially be more detrimental than beneficial over the long-term rate for the mature citizens.

Observing the history of Social Security benefit taxes, their introduction wasn’t until 1984. An additional layer of benefit tax was later introduced in 1994, and from that point on, the taxation system has remained steady. Taxes could be levied on a part of retirees’ benefits, depending on their provisional income. This simply refers to their adjusted gross income plus any non-taxable interest earned during the year, along with half of their annual Social Security benefit.

This system does not equate to losing up to 85% of your benefits. It denotes that up to 85% of your benefits could be taxed based on your normal income tax rate. These thresholds haven’t seen an update in three decades, meaning as average benefits increase, the taxman’s interest in senior pockets inherently does too. Annually, more retirees are subject to these tax conditions.

Riding the Trump train by dissolving the Social Security benefit tax suggests eliminating one of the program’s trio of income sources. The remaining two being the Social Security payroll taxes paid by workers and the interest accrued by the program’s trust funds. A short-term band-aid could be an increased withdrawal from the trust funds to compensate for the lost revenue.

However, this is not a sustainable solution. Despite the program’s current setup with benefit taxes present, full payout of benefits from Social Security can only last till around 2035. This coincides with the expected depletion of the trust fund reserves. If no measures are put in place to boost funding for the program by then, retirees might bear a 23% reduction in benefits.

Removing the Social Security benefit tax would only hasten this deadline. This potential 23% reduction in benefits could be much more damaging for seniors than meeting tax obligations on a portion of their yearly benefits. Although Trump floated the idea of dismissing these income taxes on benefits, the president can’t wield this power single-handedly.

Congress has to be convinced to pass a bill that would eliminate this tax. Even though Republicans have a majority in both the House and Senate, making this happen won’t be a walk in the park. Nobody anticipates a resolution to be reached immediately in 2025, casting doubt on the future of such a move.

The uncertain outcome of this matter may not surface until a more extensive review of Social Security reforms is carried out. Such reforms aim to provide a sustainable future for the program that ensures incoming generations can also benefit. Whether or not Trump’s proposal will be implemented is yet to be seen. If it does materialize, it’s likely it would be part of more comprehensive changes to the Social Security system.