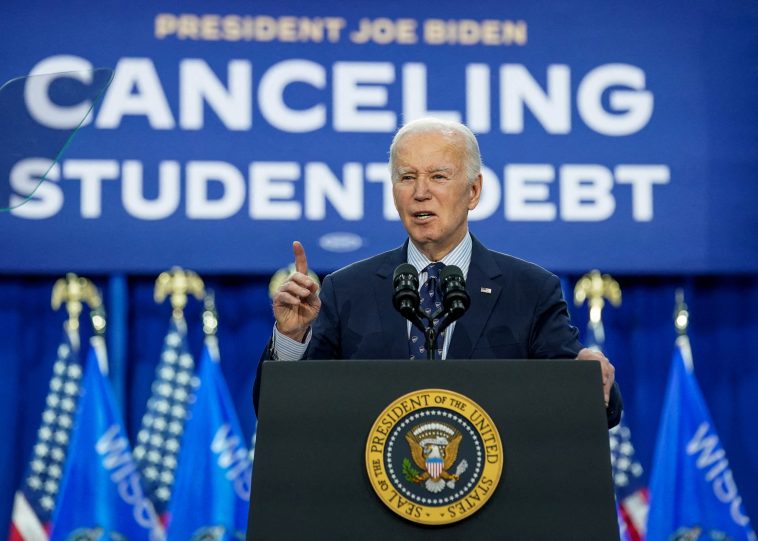

This Wednesday, the United States Supreme Court made a determining decision not to proceed with President Biden’s proposition for student loan forgiveness, at this stage. This decision came amidst requests by the Justice Department, appointed by the joint Harris-Biden Administration, to remove an injunction put in place by a lower court. This injunction momentarily halted any action on student loan cancellation until contrasting lawsuits have been settled. In their succinct yet assertive order, the Supreme Court encouraged the relevant Court of Appeals to hasten its verdict without any overt dissents being noted.

Leading this charge against the student loan absolution are seven U.S. states, controlled by Republican administrations, standing firm in their resolution to obstruct the implementation of Biden’s latest venture in education. Baptized as the ‘Saving on a Valuable Education’ (SAVE) plan, it is the President’s freshest endeavor to mitigate the vast national student loan debt, following the unsuccessful appeal to utilize the HEROES Act in 2023 for the same purpose.

The SAVE plan proposes significant modifications to the existing student loan infrastructure. It aims to halve the current income-based repayment rate from 10% down to a more manageable 5% of a borrower’s discretionary income. This adjustment is designed to ease the mounting financial pressure on America’s young and aspiring academics.

Further exploring the details of the SAVE plan, it also outlines that those borrowers earning less than 225% of the federal poverty threshold wouldn’t be obliged to fulfill repayment demands. For an individual, this income limit would equate to $32,800 per annum. This initiative aims to offer relief for those at the lower ends of the income scale, thus acknowledging the link between low-income earners and struggle with student debt.

Though seemingly noble in its intentions, the enactment of the SAVE plan hasn’t gone unchallenged. It is currently embroiled in two distinct lawsuits, seeking to curb its potential effect on federal student loan management. As such, its path to becoming law is currently blocked, illustrating the contentious nature of the national student debt issue.

In the early summer months of this year, Kansas and Missouri courts delivered individual rulings which effectively stalled large portions of the proposed measures. These decisions evidenced a growing skepticism and resistance towards the administration’s approach to the student debt crisis.

Nevertheless, the student debt that had already been forgiven under the SAVE plan wasn’t rescinded due to these rulings, offering a small respite for students who had initially benefited from the plan’s implementation.

July marked a small victory for the SAVE plan, when the 10th Circuit Court of Appeals, based in Denver, granted permission for the Department of Education to carry forward with the modified repayment system, lowering borrowers’ monthly payments.

However, a ruling from the 8th Circuit Court of Appeals, located in St. Louis, imposed a standstill order on the entirety of the SAVE plan in early August. This ruling brought the entire process back to a halt, underscoring the challenge of navigating the complexities of systemic reform amidst ongoing legal debates.

Reacting to the latest developments, Education Secretary Miguel Cardona denounced the decision by expressing his disappointment, remarking that the ruling undermined a well-established tradition of loan forgiveness spanning three decades.

Despite these legal challenges, the Department of Education remains committed to providing some form of relief from the crushing burden of student loan debt. Initial reports suggest that approximately 4.7 million Americans have already been granted loan forgiveness, amounting to an estimated $168 billion in relief.

Even as the courts stand divided in their rulings on the SAVE plan, the implications of this legal battles stretch far and wide. Actions in Missouri, Kansas, and even the decisions from the 10th and 8th Circuit Courts of Appeals are pieces of a much larger discussion on student loan debt.

In the face of these legal battles, it’s clear that the student loan predicament is a substantive issue that stretches across the United States. Attempts to navigate this topic are bound to be met with resistance as they invariably involve sweeping changes to an entrenched system.

However, the Biden-Harris Administration appears to be unrelenting in the pursuit of relief for students burdened by overwhelming loan debt. The on-going saga of the SAVE plan, as well as previous attempts such as invoking the HEROES Act, demonstrates a persistent, albeit challenged, commitment.

As stakeholders sit on the edge of their seats, the nation focuses its gaze on the battling titans within the Courts of Appeals, all while the clock ticks on the lives of millions of debt-laden American students. The final outcome is still on the horizon: Will the vision of extensive student loan reform, encapsulated by the SAVE plan, become reality or remain a well-intentioned measure in legislative limbo?

The journey is far from over, as the discourse around student loan forgiveness plays out in court rooms, legislature, and households across America. The sobering tally of 4.7 million beneficiaries of debt forgiveness amidst a yet unresolved issue serves as a stark reminder of the magnitude of the problem, and the imperative need for effective reform.